Leaders in

Energy Infrastructure Asset Management

Our three decades of experience, range of focus and unwavering commitment to our clients – both institutional and individual – sets us apart.

Experience ... The Difference

For three decades, our portfolio managers have provided a leading view of the energy infrastructure markets that power the global economy. Our experience and relationships have earned us a distinct advantage in identifying and leveraging the most optimal opportunities, while our disciplined, research-driven process has an established history of attractive performance … And as responsible caretakers of the capital entrusted to us, we are committed to each client’s satisfaction and success.

and their affiliates

Featured Content

Video Presentations

State of U.S. Power Markets: Episode 3 – Load Growth Driver: Powering AI

A deep dive into the power needs of AI – including data center investment, translating dollars into watts and Hyperscaler priorities

State of U.S. Power Markets: Episode 2 – U.S. Power Generation: Demand at an Inflection Point

At a period of ever-increasing energy demand, we continue discussing various power sources and the role of natural gas and midstream

Midstream Update: Key Points, Second Quarter 2025

Video summary of our Midstream Update newsletter for the second quarter of 2025

State of U.S. Power Markets: Episode 1 – U.S. Power Generation

Discussion of various power sources and the role of natural gas and midstream in meeting increased electricity demand

Midstream Update: Key Points, Fourth Quarter 2024

Video summary of our Midstream Update newsletter for the fourth quarter of 2024

Midstream Update: Key Points, Third Quarter 2024

Video summary of our Midstream Update newsletter for the third quarter of 2024

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 11 – Midstream Capital Structure

Investigation into the investment decision, funding decision and return of capital decision

Midstream Update: Key Points, First Quarter 2024

Video summary of our Midstream Update newsletter for the first quarter of 2024

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 10 – Midstream Capital Allocation Overview, Part II

Deeper dive into key considerations of allocation decisions and focus on Chickasaw’s own allocation preferences

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 9 – Midstream Capital Allocation Overview, Part I

Review of the historical shift to capital expenditures through to the current prioritization of higher returns and investor value

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 8 – Liquefied Natural Gas (LNG) Market Overview

Coverage of the liquefied natural gas (LNG) lifecycle, from liquefaction to regasification, and its global market dynamics

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 7 – Demand Forecast 101

Discussion of Midstream companies’ role in future energy demand in the context of the U.S. Energy Information Agency’s Annual Energy Outlook through 2050

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 6 – Exports 101

Exploration of the mission-critical role that Midstream companies play in satisfying increasing international demand for U.S. raw and finished hydrocarbon products through exportation

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 5 – Natural Gas Liquids (NGLs) Market Overview

The nature of NGLs along with their value chain, applications and supply/demand factors and status

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 4 – U.S. Natural Gas Market Overview

A look at the dynamic evolution of the natural gas market in the U.S., spanning its array of applications and forecasted growth

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 3 – Crude Market Overview

A look at global crude supply, demand and forecasts for the future – along with the factors that affect all three

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 2 – Long-Term Drivers

Long-term drivers for Midstream equities through the lens of the EIA Annual Energy Outlook and the energy transition

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 1 – Midstream 101

An overview of the history of Midstream and the current outlook for investment in the sector

Chickasaw Discussion Series: Episode 3

Discussion with Alan Armstrong, Chief Executive Officer, Williams Companies Inc. (NYSE: WMB)

Chickasaw Discussion Series: Episode 2

Discussion with Jennifer Kneale, Chief Financial Officer, Targa Resources Corp. (NYSE: TRGP)

Chickasaw Discussion Series: Episode 1

Discussion with Aaron Milford, Chief Operating Officer, Magellan Midstream Partners (NYSE: MMP)

Slide Presentations

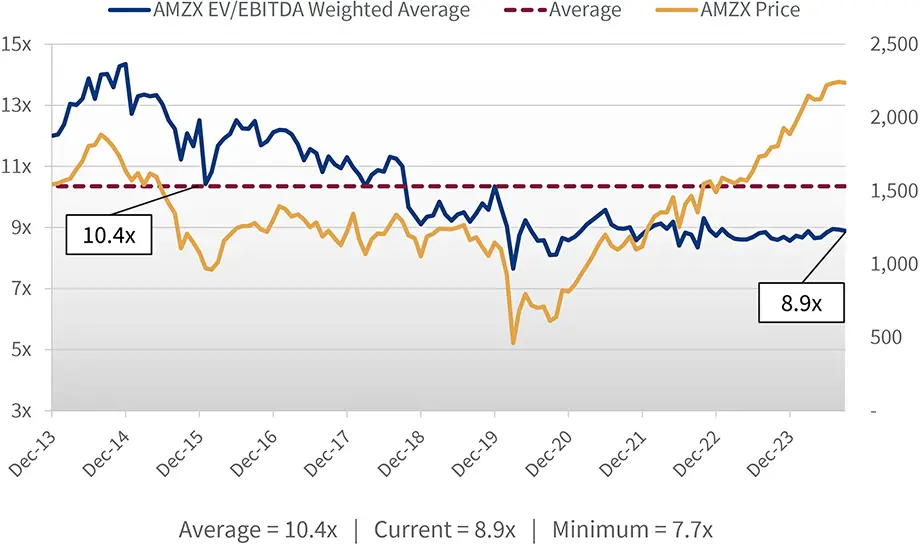

Energy Infrastructure Highlights: January 2026

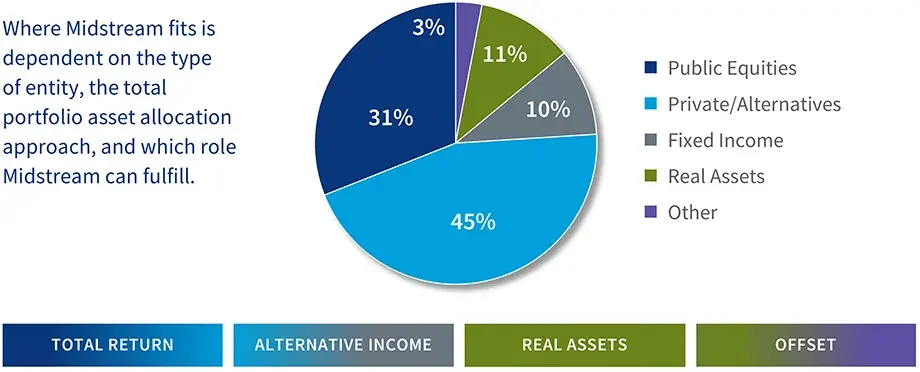

The key factors that drive investment in energy infrastructure

Why Energy Infrastructure?

Energy infrastructure delivers the molecules driving the global economy. The systems powering our business, industry, transportation, technology and daily lives are universally valued and compelled to evolve in order to meet ever-increasing demand.

Team Member Showcase

VICKIE GARDINO is a Managing Director at Chickasaw Capital Management, LLC, focused on trading. Her expertise includes all aspects of trading. Vickie served as a Client Analyst at Goldman Sachs & Co. for 7 years in Memphis and was the lead support person for a six-person investment advisory team. She has broad industry experience with over 32 years in the securities …